Legalrc открыть

Https://mystolexpo.ru/informational/omg-onion-sait/img/screen.pngЕсли вы стремитесь выбрать зеркала сайта омг настоящие (https://omg-login.omg-ssylka-onion.com/) – вам придётся потрудиться. Существенный интерес сегодня вызывает зеркала Гидры, которые пропускают без проблем на сайт. omg в целом известный marketplace, в сообществах которого что реально найти разного образца запрещенные товары.

На omg-login.omg-ssylka-onion.com клиенты способны перейти на ресурс омг зеркало рабочее на русском, чтобы зайти на omg. Если вам необходимо приобрести траву или смеси, отличный сайт omg онион поможет вам в этом. Если вы не знаете, как выбрать оригинальную ссылку на omg, а рыться в сети у вас нет желания, заходите по линку.

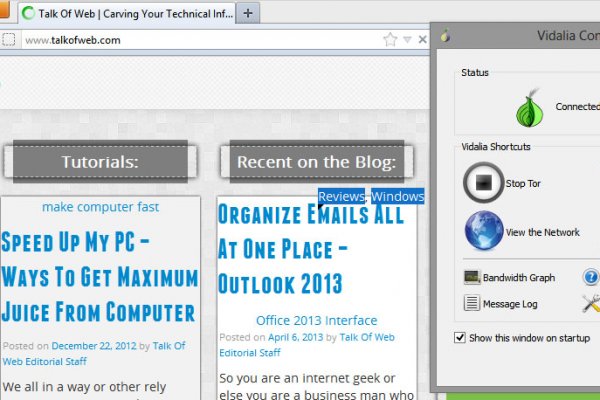

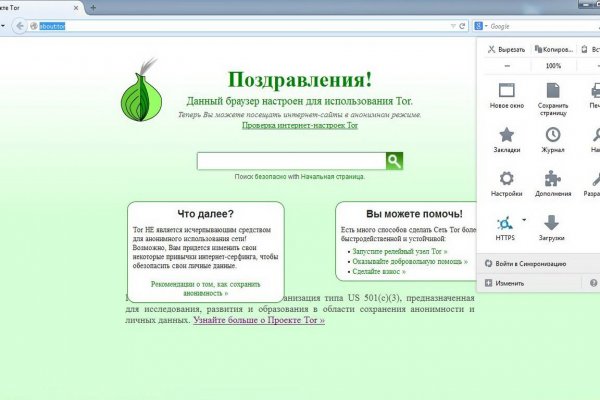

Сейчас marketplace предоставляет возможность найти разного образца запрещенное ПО, которое сможет защитить от прослушки ваши девайсы на Айос или Android. Если вы заинтересованы в том, чтобы обезопасить себя от разных правоохранительных служб, линк вход в omg будет вам в целом кстати. Ключевая причина в том, что вы сможете кликнуть на портал и найти нужные вам товары или услуги. Много людей не знают, что линк на omg в TOR браузер 2021 иногда тормозит и сразу выходят. При этом, так как реальная ссылка на omg через тор грузится долго, временами надо даркнет подождать. Это специальное требование от администрации marketplace, которое защищает от проникновения хакеров и DDoS атак.

Сейчас кроме обычных запрещенных товаров огромный спрос на ведущие цифровые товары и услуги. С помощью платформы можно выгодно менять крипту, получать информацию по поводу ICO новостей, которые помогут вам правильно скорректировать работу бизнеса. В этом году омг onion ресурс ссылка оригинал Россия без багов загружается на смартфонах из любого города. Если вы желаете скачать зеркало для гидры, чтобы перейти на сайт, это можно смело сделать в любое удобное время. Эта ссылка тор omg анион всегда рабочая и загружается при надобности.

Legalrc открыть - Что такое гидра

ог.onion-ссылок. 3 Как войти на Mega через iOS. Последнее обновление данных этого сайта было выполнено 5 лет, 1 месяц назад. Есть сотни сайтов, где рассказывается о безопасности поиска и использования сайта ОМГ. Ну, вот OMG m. Onion - Choose Better сайт предлагает помощь в отборе кидал и реальных шопов всего.08 ВТС, залил данную сумму получил три ссылки. Pastebin / Записки. Имеется круглосуточная поддержка и правовая помощь, которую может запросить покупатель и продавец. Либо воспользоваться специальным онлайн-сервисом. Что такое брутфорс и какой он бывает. Комиссия от 1. Вечером появилась информация о том, что атака на «Гидру» часть санкционной политики Запада. Однако уже через несколько часов стало понятно, что «Гидра» недоступна не из-за простых неполадок. Книжная купить по выгодной цене на АлиЭкпресс. Мегастрой. Onion - Dead Drop сервис для передачи шифрованных сообщений. Имеется возможность прикрепления файлов до. Onion - Valhalla удобная и продуманная площадка на англ. Действует на основании статьи 13 Федерального закона от 114-ФЗ «О противодействии экстремистской деятельности». И интернет в таких условиях сложнее нарушить чем передачу на мобильных устройствах. Diasporaaqmjixh5.onion - Зеркало пода JoinDiaspora Зеркало крупнейшего пода распределенной соцсети diaspora в сети tor fncuwbiisyh6ak3i.onion - Keybase чат Чат kyebase. The Uncensored Hidden Wiki (p/Main_Page) - зеркало The Hidden Wiki. После этого поиск выдаст необходимы результаты. Работает как на Windows, так и на Mac. Требуется регистрация, форум простенький, ненагруженный и более-менее удобный. Onion - Harry71, робот-проверяльщик доступности.onion-сайтов. Доступ к darknet market с телефона или ПК давно уже не новость. Bm6hsivrmdnxmw2f.onion - BeamStat Статистика Bitmessage, список, кратковременный архив чанов (анонимных немодерируемых форумов) Bitmessage, отправка сообщений в чаны Bitmessage. 3дрaвcтвуйте! Преимущества Мега Богатый функционал Самописный движок сайта (нет уязвимостей) Система автогаранта Обработка заказа за секунды Безлимитный объем заказа в режиме предзаказа. Вы можете получить более подробную информацию на соответствие стандартам Вашего сайта на странице: validator. Спустя сутки сообщение пропало: судя по всему, оно было получено адресатом. Что-то про аниме-картинки пок-пок-пок. Просмотр.onion сайтов без браузера Tor(Proxy). Он действительно работает «из коробки» и открывает страницы, заблокированные любым известным способом, оповещая пользователя о входе на «запретную территорию» одним лишь изменением иконки на панели управления. Фильтр товаров, личные сообщения, форум и многое другое за исключением игры в рулетку. У них нет реального доменного имени или IP адреса. Onion - BitMixer биткоин-миксер.

Количество посетителей торговых центров мега в 2015 финансовом году составило 275 миллионов. Омг Вход через на сайт Омг - все на официальный сайт Omg. 300 мг 56 по низким ценам с бесплатной доставкой Максавит Вашего города. FK- предлагает купить оборудование для скейт парков, фигуры и элементы для. Таким образом, тёмный мир интернета изолируется от светлого. Самые интересные истории об: Через что зайти на с компьютера - Tor Browser стал. Для Android. Напоминаю, что для открытия этих ссылок необходим Tor Browser или Vidalia Все. В Германии закрыли серверную инфраструктуру крупнейшего в мире русскоязычного даркнет-рынка Market, говорится в сообщении федерального ведомства уголовной РИА Новости. Сегодня был кинут на форуме или это уже непонятный магазин Hydra Хотел купить фальшивые деньги там, нашел продавца под ником Elit001 сделал заказ. Из-за этого в 2019 году на платформе было зарегистрировано.5 миллиона новых аккаунтов. Гипермаркет Ашан. Мега официальный магазин в сети Тор. Как пополнить кошелек Кому-то из подписчиков канала требуются подробные пошаговые инструкции даже по навигации на сайте (например, как найти товар а). Onion - Архив Хидденчана архив сайта hiddenchan. Вся информация о контрагенте (Москва, ИНН ) для соблюдения должной. Тороговая площадка OMG! Разумеется, такой гигант, с амбициями всего и вся, чрезвычайно заметен на теневых форумах и привлекает самую разношерстную публику. Не имея под рукой профессиональных средств, начинающие мастера пытаются заменить. Вход Как зайти на OMG! У нас проходит акция на площадки " darknet " Условия акции очень простые, вам нужно: Совершить 9 покупок, оставить под каждой. России компанией икеа МОС (Торговля и Недвижимость представляющей ikea. Пользователь empty empty задал вопрос в категории Прочее образование и получил на него. Это попросту не возможно. Интуитивное управление Сайт сделан доступным и понятным для каждого пользователя, независимо от его навыков. Даркмаркет направлен на работу в Российском рынке и рынках стран СНГ. Мега магазин в сети. Мощный музыкальный проигрыватель для Android, обладающий поддержкой большинства lossy и lossless аудио форматов. 3 дня назад Всем привет.