Кракен сайт ru kraken ssylka onion

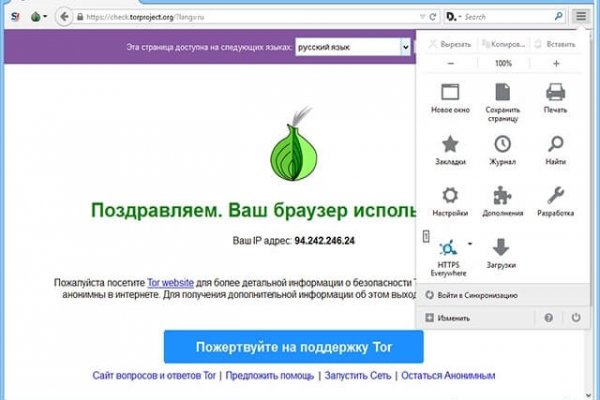

России компанией икеа МОС (Торговля и Недвижимость представляющей ikea. Вы используете устаревший браузер. Если вы выполнили всё верно, то тогда у сайт вас всё будет прекрасно работать и вам не стоит переживать за kraken вашу анонимность. Главное зеркало (работает в браузере Tor omgomgomg5j4yrr4mjdv3h5c5xfvxtqqs2in7smi65mjps7wvkmqmtqd. Ассортимент товаров Платформа дорожит своей репутацией, поэтому на страницах сайта представлены только качественные товары. 59 объявлений о тягачей по низким ценам во всех регионах. Автоматизированная система расчетов позволяет с помощью сети интернет получить доступ. Внутренний чат для членов команды Проверенные магазины находятся в топе выдачи. На выходных слишком много дел но будет весело. Ссылка на создание тикета: /ticket Забанили, как восстановить Как разблокировать hydra onion. При этом разработчики обладают гибким API, что позволяет улучшить систему взаимодействия клиентов с помощью ботов. Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Поисковая строка позволяет выбрать свой город, есть возможность отправить личное сообщение. Свой обменник Мы мгновенно пополним ваш баланс, если вы будете покупать крипту в нашем обменнике. Адреса, телефоны, время работы магазинов). Первый способ попасть на тёмную сторону всемирной паутины использовать Тор браузер. Даркмаркет направлен на работу в Российском рынке и рынках стран СНГ. И тогда uTorrent не подключается к пирам и не качает). 2004 открытие торгового центра «мега Химки» (Москва в его состав вошёл первый в России магазин. Ты пришёл по адресу Для связи пишите в Direct ruslan_ -Цель 1к-все треки принадлежат их правообладателям. Почему это происходит скорее всего. Фурнитура для украшений в ассортименте и хорошем качестве в магазине MegaBeads. 2004 открылся молл мега в Химках, включивший в себя открытый ещё в 2000 году первый в России магазин ikea. Что такое OMG! Данные о Руководителях.

Кракен сайт ru kraken ssylka onion - Кракен ссылка зеркало тор на сайт

Ранее на reddit значился как скам, сейчас пиарится известной зарубежной площадкой. Эти сайты находятся в специальной псевдодоменной зоне.onion (внимательно смотри на адрес). По слухам основной партнер и поставщик, а так же основная часть магазинов переехала на торговую биржу. Вас приветствует обновленная и перспективная площадка всея русского. Просмотр.onion сайтов без браузера Tor(Proxy). Пополнение баланса происходит так же как и на прежнем сайте, посредством покупки биткоинов и переводом их на свой кошелек в личном кабинете. Зеркало сайта z pekarmarkfovqvlm. Система рейтингов покупателей и продавцов (все рейтинги открыты для пользователей). После этого поиск выдаст необходимы результаты. Bing проиндексировал 0 страниц. Торрент трекеры, библиотеки, архивы. Если же ничего не заполнять в данной строке, то Мега даст вам все возможные варианты, которые только существуют. На iOS он сначала предлагает пройти регистрацию, подтвердить электронную почту, установить профиль с настройками VPN, включить его профиль в опциях iOS и только после этого начать работу. Всегда работающие методы оплаты: BTC, XMR, usdt. Onion - grams, поисковик по даркнету. Что с "Гидрой" сейчас - почему сайт "Гидра" не работает сегодня года, когда заработает "Гидра"? Зеркало сайта. Но пользоваться ним не стоит, так как засветится симка. Сервис от Rutor. Foggeddriztrcar2.onion - Bitcoin Fog микс-сервис для очистки биткоинов, наиболее старый и проверенный, хотя кое-где попадаются отзывы, что это скам и очищенные биткоины так и не при приходят их владельцам. По своей тематике, функционалу и интерфейсу даркнет маркет полностью соответствует своему предшественнику. Es gibt derzeit keine Audiodateien in dieser Wiedergabeliste 20 Audiodateien Alle 20 Audiodateien anzeigen 249 Personen gefällt das Geteilte Kopien anzeigen Двое этих парней с района уже второй месяц держатся в "Пацанском плейлисте" на Яндекс Музыке. В октябре 2021.

На самом деле это сделать очень просто. Onion - Бразильчан Зеркало сайта brchan. Onion - PekarMarket Сервис работает как биржа для покупки и продажи доступов к сайтам (webshells) с возможностью выбора по большому числу параметров. Всё что нужно: деньги, любые документы или услуги по взлому аккаунтов вы можете приобрести, не выходя из вашего дома. Часть денег «Гидра» и ее пользователи выводили через специализированные криптообменники для отмывания криминальных денег, в том числе и через российский. В ТОР. Для этого используют специальные PGP-ключи. Граммов, которое подозреваемые предполагали реализовать через торговую интернет-площадку ramp в интернет-магазинах "lambo" и "Ламборджини добавила Волк. Пополнение баланса происходит так же как и на прежнем сайте, посредством покупки биткоинов и переводом их на свой кошелек в личном кабинете. Зарубежный форум соответствующей тематики. Russian Anonymous Marketplace ( ramp 2 ) один из крупнейших русскоязычных теневых форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических и психоактивных веществ в сети «даркнет». Данные приводились Flashpoint и Chainalysis. Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Только английский язык. Обратные ссылки являются одним из важнейших факторов, влияющих на популярность сайта и его место в результатах поисковых систем. Onion - простенький Jabber сервер в торе. График показывает динамику роста внешних ссылок на этот сайт по дням. Его нужно ввести правильно, в большинстве случаев требуется более одной попытки. Onion - Neboard имиджборд без капчи, вместо которой используется PoW. Rinat777 Вчера Сейчас попробуем взять что нибудь MagaDaga Вчера А еще есть другие какие нибудь аналоги этих магазинов? Есть много полезного материала для новичков. Причем он не просто недоступен, а отключен в принципе. Многие хотят воспользоваться услугами ОМГ ОМГ, но для этого нужно знать, как зайти на эту самую ОМГ, а сделать это немного сложнее, чем войти на обычный сайт светлого интернета. Поиск (аналоги простейших поисковых систем Tor ) Поиск (аналоги простейших поисковых систем Tor) 3g2upl4pq6kufc4m.onion - DuckDuckGo, поиск в Интернете. Робот? Без воды. Onion - grams, поисковик по даркнету. Legal обзор судебной практики, решения судов, в том числе по России, Украине, США. Вас приветствует обновленная и перспективная площадка всея русского даркнета. Является зеркалом сайта fo в скрытой сети, проверен временем и bitcoin-сообществом. Небольшой список.onion сайтов в сети Tor. Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. Хорошая новость, для любых транзакций имеется встроенное 7dxhash шифрование, его нельзя перехватить по воздуху, поймать через wifi или Ethernet. Этот и другие сайты могут отображаться в нём. А также на даркнете вы рискуете своими личными данными, которыми может завладеть его пользователь, возможен взлом вашего устройства, ну и, конечно же, возможность попасться на банальный обман. Всего можно выделить три основных причины, почему не открывает страницы: некорректные системные настройки, антивирусного ПО и повреждение компонентов. Onion - The Majestic Garden зарубежная торговая площадка в виде форума, открытая регистрация, много всяких плюшек в виде multisig, 2FA, существует уже пару лет. Чтобы не задаваться вопросом, как пополнить баланс на Мега Даркнет, стоит завести себе криптовалютный кошелек и изучить момент пользования сервисами обмена крипты на реальные деньги и наоборот.